Migrating North for Investment

This week, we were contacted by Delph Property Group to work on an analysis of Manchester and Liverpool as property investment opportunities. Delph Property Group are a residential investment company who provide collaborative partnerships in residential developments. They have just launched a fantastic whitepaper comparing Manchester and Liverpool and assessing both city’s redevelopment plans, property trends and levels of potential.

A while ago, we wrote about the reasons to purchase property in Manchester, and the reasons to purchase property in Liverpool. Delph Property Group support our research and claim that “Liverpool and Manchester are two of the most prominent cities at the heart of England’s Northern Powerhouse – a project designed to boost economic growth and redistribute the national economy.” (1) Property Moose’s Operations Director, Ben Lloyd, recently wrote an article about the Northern Powerhouse, highlighting the £6 billion investment plan aimed to fuel local economic growth, increase jobs and improve transport. We have also recently written about the respective improvements to infrastructure, and the connectivity of the Northern Powerhouse. Now, thanks to the research published by Delph Property Group, we can dive into the facts and truly understand the potential of these property investment hotspots, as opposed to other popular choices, like London.

According to Delph Property Group’s research, “Theresa May stated that the country has been dependent on growth in London for too long.” (1) This is supported by John Lanchester, author of Capital and How to Speak Money, who claims “[London is] where all the media is, all the power is, all the culture is, all the money is.” (2) The BBC compare this to Germany, “where the political capital Berlin is balanced by a financial hub in Frankfurt and powerful industrial and media centers in Munich and Hamburg.” (2) Likewise, “New York’s global status doesn’t diminish Washington’s political clout, Los Angeles’ entertainment output or San Francisco’s position at the vanguard of the technology industry.” (2) And so comparison renders London’s hub-of-everything status to be an anomaly. However, this reputation London has acquired began long ago in 43 AD, when the Romans invaded Britain and decided to settle just north of the Thames. In addition, “As the British Empire began its ascendancy, London’s location proved ideal. Power was shifting from the Mediterranean to northern Europe, and trade routes were opening up to the New World.” (2) And although ports like Liverpool began to grow in importance around the 17th century, and grew further during the industrial revolution alongside Manchester, it all came back to London. Both Liverpool and Manchester had “their own stock exchanges [and] their own newspapers. But their challenge to the capital was never sustained.” (2) In fact, by the end of the 19th century, all this trade “had shifted back to London.” (2)

But it seems this might be coming to a slow decline. Perhaps London’s magnetism is slowly weakening. Just last month we wrote an article inspired by the recent exodus of 30-somethings from London, and the Evening Standard has just posted news about young Londoners heading to Margate to “escape the capital’s sky-high property prices.” (3) Shockingly, “In 2013 it was estimated that in property terms London’s top 10 boroughs were worth more than all of Northern Ireland, Scotland and Wales combined.” (2) In addition, “London’s housing stock is worth as much as Brazil’s annual GDP, estate agents Savills reported in January 2015.” (2)

In fact, I recently wrote an article about what we can learn from foreign investment behaviour. Essentially, I concluded that foreign investment behaviour highlights that London is losing its charm. It seems we ought to pack our bags and head up the M6 to Manchester or Liverpool. This simply boils down to cheaper prices, huge amounts of growth planning and an improvement in transport links. This is no surprise, as the two cities have been under the spotlight for investors as of late. As a result, it’s definitely been a hot topic here on our Economoose blog, too.

Although the city failed in its bid to host the 1996 and 2000 Olympic Games, the 2002 Commonwealth games were “a real turning point for Manchester,” (1) according to Delph Property Group. The city is blooming under redevelopment, with many buildings dating back to the 1960’s “being updated with more modern features.” (1) In fact, areas like The Green Quarter, which was once a “derelict wasteland” has in fact since become “the backdrop for one of the most ambitious regeneration projects in Manchester’s recent history.” (1) Another subsequent area that investment has breathed life back in to is Salford. “Between 2003 and 2006 alone more than £115m was invested into the housing stock for residents of Manchester and the City of Salford, resulting in fantastic urban renewal.” (1) In response to the argument made about London being the hub-of-everything, including media companies, we ought to consider the creation of MediaCityUK, which has led to Salford City “becoming a national hub for media production and is now the home to the BBC.” (1)

In 2008, Liverpool beat London and earned the title of European Capital of Culture. (1) Since then, it has “transformed into one of the UK’s leading business and leisure destinations, underpinned by an ambitious and far-reaching regeneration programme that’s hauled Liverpool out of its post-industrial doldrums.” (1) Liverpool has invested £19m in a cruise liner terminal, which “now welcomes dozens of cruise ships and has become undoubtedly one of the most desirable cruise destinations in Europe; building on the city’s rich maritime heritage. With 115,000 passengers and crew expected to disembark from around the world in 2016, Liverpool is fast becoming a great place for tourists to explore.” (1) According to Delph Property Group, however, the most impressive area of development on the skyline of Liverpool’s Docklands is West Tower: a 40-storey skyscraper that’s now the tallest building on the city’s landscape, featuring high-end apartments, fine dining and ample business space.” (1) Other redevelopments include the Liverpool ONE complex, which breathed life in to “42 acres of previously underutilised land in the heart of Liverpool city centre at a total investment cost of £920m.” In fact, it’s one of the largest open-air shopping centres in the UK. (1)

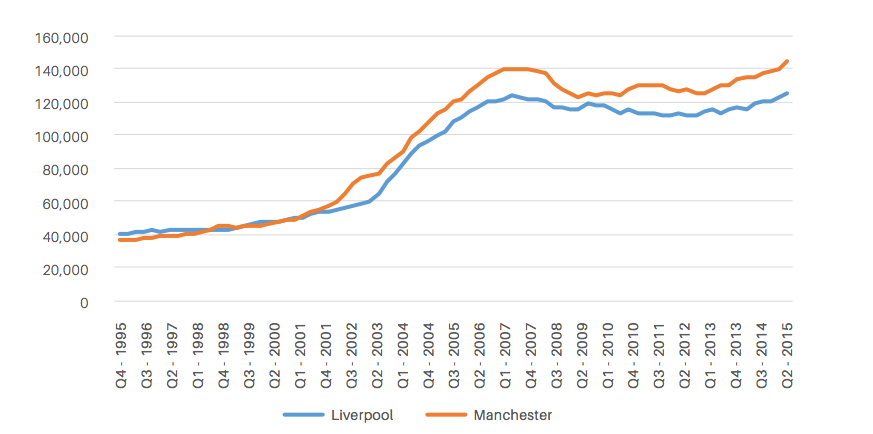

Between 2009 and 2015, there was a 77% increase in residential property sales in Liverpool, and a 5% increase in population. (1) In Manchester, during the same time frame, there was a 63% increase in residential property sales and a 10% increase in population. (1) This certainly is “impressive growth in sales of residential property” (1) since the recession lows in 2009.

Source: Delph Property Group (1)

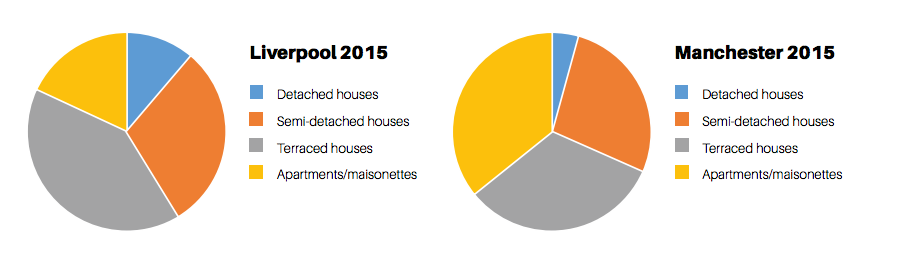

Indeed, “the figures from the ONS show that all types of residential properties registered increased sales in Manchester and Liverpool.” (1) In Manchester, apartment and maisonette sales were more frequent than they were in Liverpool. In fact, “36% of residential properties sold in Manchester in 2015 were apartments or maisonettes.” (1)

Source: Delph Property Group (1)

Data published in June 2016, by the Office for National Statistics “shows a considerable difference in the number of people aged 16-39 years old in Liverpool (187,800) than Manchester (246,400).” (1) Delph Property Group notes that “With more young professionals seemingly residing in Manchester, the demand for stylish, accessible accommodation is understandably high and could explain why apartments and maisonettes are more readily available and sell with greater regularity there.” (1) Although only 15% of all residential stock sold in Manchester were new build sales, and 12% in Liverpool, there is no doubt that these figures will increase, especially considering the continued regeneration of both cities as landmarks in the Northern Powerhouse. (1)

Bill Enevoldson, Chief Investment Officer of Greater Manchester Combined Authority core investment team notes that, “There’s a big appetite from institutional investors, mainly because the yields here are better than London.” (1) Residential property is seemingly hot in Manchester and Liverpool. According to Nicholas Belkin, Head of Acquisitions at Delph Property Group, “Investors across the world are competing with first-time buyers to purchase all types of new build developments across Manchester and Liverpool. The North West is beginning to offer fantastic returns on capital for investors and with property markets in Manchester and Liverpool stabilising and recovering well post-recession confidence is certainly on the up.” (1)

And so, in response to John Lanchester’s previously discussed claim that “[London is] where all the media is, all the power is, all the culture is, all the money is,” (2) we could argue that Manchester is becoming home to the all the media, Liverpool is becoming home to all the culture and all the money (as far as foreign investment is concerned) is heading to the Northern Powerhouse too. (4) As for all the power, the clue is in the name.

You can read the Delph Property Group’s whitepaper here.

Written by Jenna Kamal

Sources:

- http://delphgroup.com/liverpool-vs-manchester-residential-property-trends/

- http://www.bbc.co.uk/news/resources/idt-248d9ac7-9784-4769-936a-8d3b435857a8

- http://www.standard.co.uk/news/london/young-londoners-head-to-margate-to-escape-the-capitals-skyhigh-property-prices-a3382721.html

- https://propertymoose.co.uk/blog/what-can-foreign-investment-teach-us/

Disclaimer and Legals

Property Moose does not provide any advice in relation to investments and you must rely on your own due diligence before investing. Please remember that property prices can go down as well as up and that all figures, rates and yields are projections only and should not be relied on. If in doubt, please seek the advice of a financial adviser. Your capital is at risk if you invest. This post has been approved as a financial promotion by Resolution Compliance Limited.

Property Moose is a trading name of Crowd Fin Limited which is an Appointed Representative of Resolution Compliance Limited which is authorised and regulated by the Financial Conduct Authority (no: 574048).