Regardless of which asset class you choose to invest in, be it cash, equities, bonds, loans, property or commodities, it’s important to pay close attention to the asset’s underlying level of liquidity. An investment’s liquidity is gauged by how quickly and easily you can withdraw your capital and put it in your pocket.

If you needed immediate financial freedom (in the form of cash), investments with low levels of liquidity could put you in a difficult position. It might be worth considering, if I needed to, how quickly could I trade this in for cash? And if the answer is not-so-quickly, you’ll need to be comfortable with having the invested amount being tied up.

The most liquid investment, of course, would be a cash-based account, where your money is easily accessible. It’s likely that you’ll be able to withdraw your cash the same day you decide to, without compromising its value. It’s, therefore, no surprise that cash is favoured across different generations. 39% of millennials have chosen cash as their favourite asset class and hoarding cash has become common amongst pensioners.

For risk-averse investors, low risk, low return cash-based accounts can be perfectly suitable. Risk is a very personal thing. It’s something you need to be comfortable with. Even for risk-taking investors, there’s no doubt that you should have an emergency fund in the bank. However, in regards to the money you’re willing to invest, keeping it in cash comes with a set of downfalls. For example, it can lose value (also known as purchasing power) over periods of inflation and offers low returns. The ‘safe’ benefit of liquidity arguably comes at a cost. If you’re hoping to pursue capital growth, cash-based accounts might not be the best option.

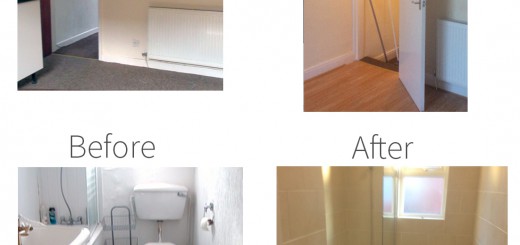

Illiquid assets tie your money up a little tighter. Take traditional property investment, for example. You can’t pull cash out of a house the way you can pull it out of a savings account. In order to get your cash back out of a property investment, it might be a lot harder. Not only might you need to sell the entire asset, but with the average time to sell a property in the UK being estimated at 6 weeks according to the Telegraph, it isn’t a quick trade, and potentially involves a lot of effort. It’s also worth noting that liquidity hopes to trade in an asset for cash fairly, without forcing you to lose out on your capital. So, although flogging your house for less than it’s worth just to get some cash is an option, it isn’t ideal.

This is one of the main risks associated with property investment. Despite the wealth of potential benefits, there’s a worrying lack of liquidity. Handling the naturally illiquid nature of property is something investors need to pay attention to.

It can feel like a major obstacle. Although the monthly rental income you can earn from a tenanted buy-to-let investment can provide you with accessible cash, it’s unlikely that this will compare to the amount of money you’ve got tied up the actual bricks and mortar.

On that note, traditional property investment can be incredibly expensive. The amount of cash you’ll have tied up could be a hefty figure. In order to become a buy-to-let landlord, you’ll probably need to own your own home first, and in order to do that, you’ll need to scrape together about 17% of the property’s price to take out a mortgage. The seemingly inaccessible housing market might feel like a closed door.

Until now. On our property crowdfunding platform, we’re trying to combat two of these major obstacles associated with traditional property investment. Here’s how.

| Traditional Property Investment | Property Crowdfunding with Property Moose |

| Expensive | We’re on a mission to democratise property investment. You don’t need a mortgage to call yourself a landlord - you just need £10. With such a low entry point, we hope to give our members the tools they need to build diverse property portfolios at a pace that’s suited to their investment goals. You don’t need to buy the whole house, you can just buy a slice of it - and earn any proportionate income. |

| Illiquid | In September 2016, we launched our very own online trading platform: our Secondary Marketplace. If you want to cash in your shares, simply list them for sale on our market at a price of your choosing. If a willing buyer likes the look of your offer, they can purchase your shares off of you in a quick and easy transaction. |

Thanks to our Secondary Market, you can opt in and out of our investment opportunities by selling your shares at any point during the investment term, subject to there being a willing buyer.

Property Moose CEO and founder, Andrew Gardiner, explained, “Essentially, we wanted to provide the option of liquidity to our investors, which is quite a hard thing to come by in the world of property investment.”

To learn more about our Secondary Market, and how it can potentially offer you property investment with higher liquidity, download our free guide.

By Jenna Kamal

Disclaimer and Legals

Property Moose does not provide any advice in relation to investments and you must rely on your own due diligence before investing. Please remember that property prices can go down as well as up and that all figures, rates and yields are projections only and should not be relied on. If in doubt, please seek the advice of a financial adviser. Your capital is at risk if you invest. This post has been approved as a financial promotion by Resolution Compliance Limited.

Property Moose is a trading name of Crowd Fin Limited which is an Appointed Representative of Resolution Compliance Limited which is authorised and regulated by the Financial Conduct Authority (no: 574048).

Never moose a beat. Our best articles delivered straight to your inbox. Subscribe today: