Investment Case Study: County Durham

We’ve previously written about County Durham as an investment hotspot, but since then, new research has highlighted a few more specific benefits.

About + Tourism

County Durham is situated in the North East of England and is steeped in both history and culture. The area spans from the east coast of England to the Pennies, and from “the River Tyne to the River Tees.” (1)

Source: Google Maps

The county boasts of stunning medieval castles as well as one of the most picturesque waterfalls in England, named High Force. In addition, the Living Museum of the North in Beamish features “one of the most important collections of social history in the world.” (1) With stunning landscapes, relaxing beaches and an array of spectacular heritage, County Durham has plenty to offer.

A recent jaw-dropping tourist attraction was the remarkable “live-action night show, presented by Eleven Arches,” (2) which took place every night of summer in 2016. The spectacle, named “Kyren, an Epic Tale of England,” (2) takes audiences on a riveting 90-minute journey through 2,000 years of British history. (2) The show takes place on a 7.5 acre stage, set against the beautiful backdrop of Auckland Castle. “More than 1,000 volunteers were involved as cast and crew, having been professionally trained under the direction of Steve Boyd, the creative talent behind the choreography of the London 2012 Opening Ceremony. With an accompanying cast of animals comprising performance horses, sheep, pigs, goats, cattle and even ducks, Kynren welcomed up to 8,000 visitors every night.” (2) The show will be back in 2017.

Housing Market

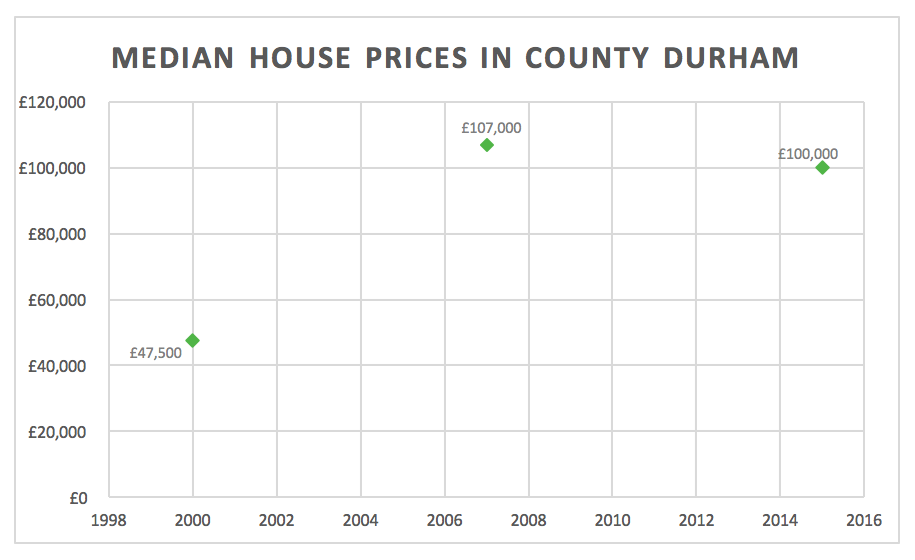

The County Durham Strategic Market Assessment, published in June 2016, impressively outlined the growth and potential of County Durham’s housing market. To summarize, the “Median prices in County Durham have been consistently slightly lower than median prices for the North East, which are well below those for England as a whole. Overall, prices have increased from £47,500 in 2000 to £100,000 in 2015, an increase of 111%. Prices peaked at £107,000 in 2007 but have since fluctuated and fallen slightly. During 2015, median prices across County Durham were £100,000 and lower quartile prices were £62,000.” (3)

(Source: County Durham Strategic Market Assessment: 3)

Please note that past performance is not a reliable indicator of future results.

In 2007, landlords expected an average return of 9.12% on a property in Durham. (4) Interestingly, this has maintained itself, and in the first quarter of 2016, the average yield of a 2-bedroom property in Peterlee, County Durham, was 9.1%. This does, however, vary slightly in Stanley, County Durham, which projects an average yield of 7.7%. (5)

| 2 Bedroom Property | Peterlee | Stanley |

| Average Rent | £401 | £390 |

| Average Asking Price | £53,190 | £60,819 |

| Yield | 9.1% | 7.7% |

(Source, This is Money: 5)

Impressively, 50% of Rightmove’s list of locations for best yields were in County Durham; both Peterlee and Stanley made the top four. (5) This bodes well for property investment, as the low prices and high yields offer the potential of great returns.

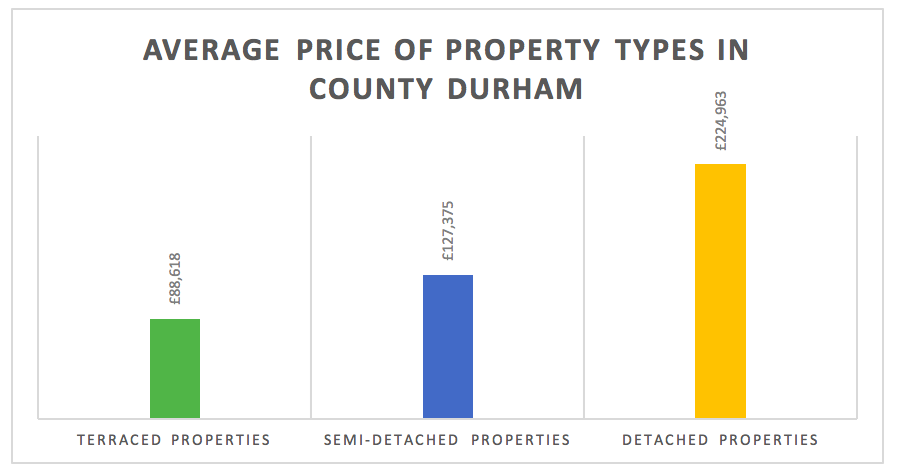

Rightmove notes that the majority of sales in County Durham during the last year were terraced properties, which were sold at an average price of £88,618. Semi-detached properties sold at an average of £127,375 and detached properties sold at an average £224,963. (6)

(Source: Rightmove: 6)

Economic Activity

Research shows that during the 2001 and 2011 Census, economic activity rates increased in almost every single age group in County Durham. (7) This indicates that growth in the county is increasing across a wide variety of demographics.

Growth Predictions

Research by Savills shows that County Durham’s housing market is on the rise and will continue to grow due to positive employment growth. In addition, “prime property values across the north of England are expected to rise by 18.12% over the next 5 years.” (8)

In addition, Darlington and other villages that surround County Durham will mirror this positive increase and grow by the same figure and at the same pace. Savills concludes this to be a result of local economies strengthening and buyers becoming more aware of the “comparative value the area has to offer.” (8)

Invested Interest

An article published in June, 2016, highlighted that a £20 million investment fund in for County Durham has been given the green light and is set to go ahead. The approved scheme will create “Finance Durham,” (9) a fund which is aimed to grow local businesses and consequently create thousands of jobs within the county. (9) In order to approve the fund’s efficiency, the scheme will make similar investments to those of a traditional venture capital fund. Essentially, this means that, “not only will companies benefit from the support, but, by targeting businesses with potential for high growth, Finance Durham is estimated to make a return of around £6 million in its first 10 years.” (9) This could be fantastic news for investors who are looking to find areas with high potential for growth in the next decade.

Another impressive factor is that County Durham is currently the centre of Hitachi Rail Europe’s venture to create “three and four car trains for the ScotRail franchise.” The 100mph commuter trains, also known as Class 385s are being built in Newton Aycliffe, County Durham. (10) The trains are set to run from late 2017 “on electrified lines between Edinburgh and Glasgow, as well as routes covering Stirling, Alloa and Dunblane.” (10)

Moreover, the approved development of a £190 million site in Bowburn, County Durham, could potentially create 4,000 jobs. (11) The scheme, named Integra 61, “will boast a 70-bedroom hotel, a residential care home, restaurants, a GP surgery, roadside retail unites and up to 270 new homes once completed, adding almost £2bn to the region’s economy in its first ten years.” (11)

Therefore, research certainly provides a strong case for County Durham as a potentially great investment hotspot. Here at Property Moose, we frequently source properties in the area based on such data, giving our investors a good chance to receive better returns on their investments.

Written by Jenna Kamal

Sources

- http://www.businessdurham.co.uk/inward-investment-county-durham/durham-a-great-place-to-live

- http://www.thisisdurham.com/inspire-me/kynren

- Strategic Housing Market Assessment June 2016

- http://www.telegraph.co.uk/finance/markets/2813666/Durham-is-best-for-student-buy-to-let-property.html

- http://www.thisismoney.co.uk/money/mortgageshome/article-3537361/Britain-s-buy-let-market-showing-early-signs-slump-investors-factor-rising-stamp-duty-costs.html

- http://www.rightmove.co.uk/house-prices-in-County-Durham.html

- County Durham Demographic Analysis and Forecasts Feb 2016

- http://www.savills.co.uk/_news/article/72418/202829-0/5/2016/county-durham-s-housing-market-to-strengthen-as-a-result-of-positive-employment-growth

- http://www.durham.gov.uk/article/7851/Major-new-investment-fund-for-businesses

- http://www.thenorthernecho.co.uk/business/14836870.Newton_Aycliffe_trainbuilder_Hitachi_Rail_Europe_pressing_on_with_Scottish_stock/

- http://www.chroniclelive.co.uk/business/business-news/development-4000-job-county-durham-12008671

Disclaimer and Legals

Property Moose does not provide any advice in relation to investments and you must rely on your own due diligence before investing. Please remember that property prices can go down as well as up and that all figures, rates and yields are projections only and should not be relied on. If in doubt, please seek the advice of a financial adviser. Your capital is at risk if you invest. This post has been approved as a financial promotion by Resolution Compliance Limited.

Please note that past performance is not a reliable indicator of future results.

Property Moose is a trading name of Crowd Fin Limited which is an Appointed Representative of Resolution Compliance Limited which is authorised and regulated by the Financial Conduct Authority (no: 574048).